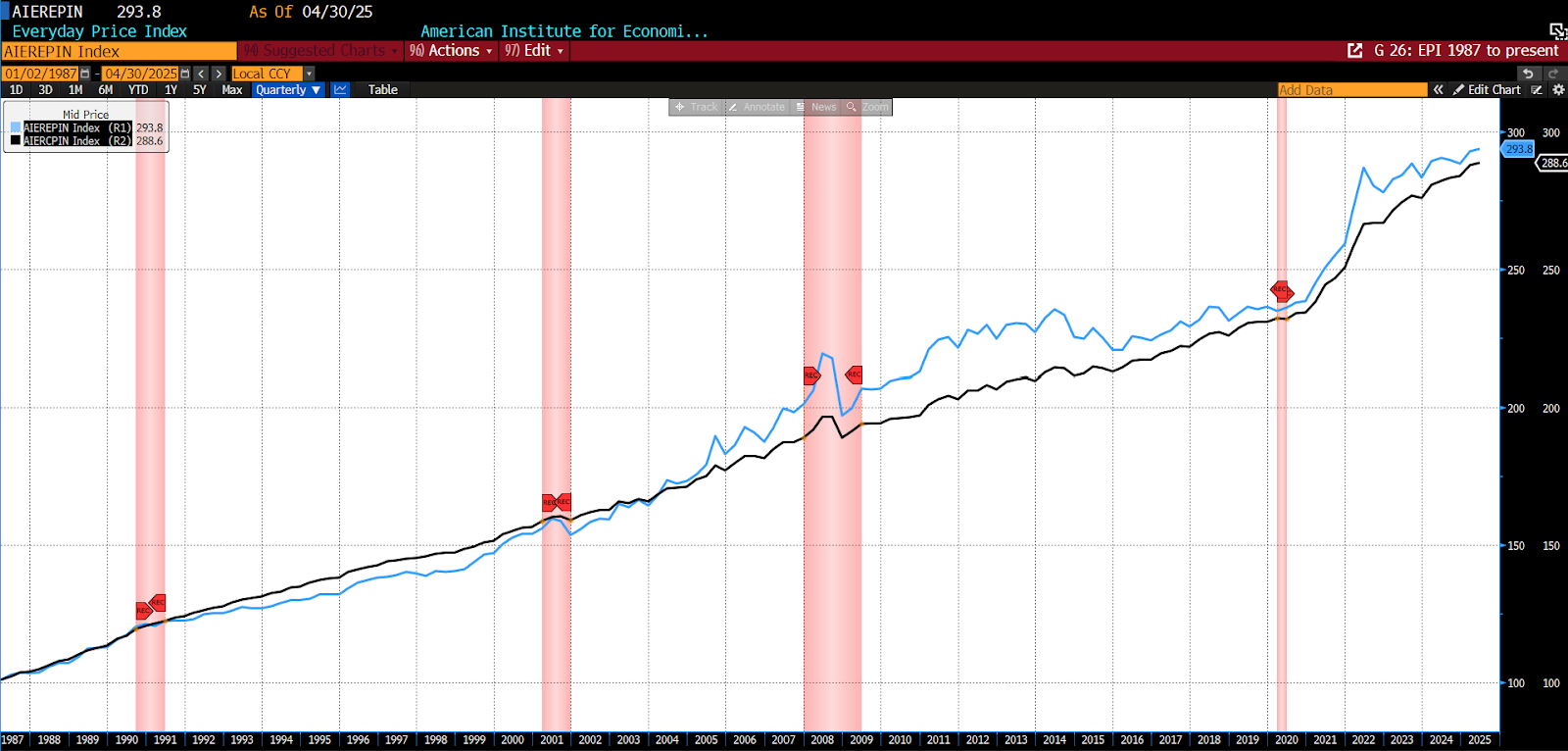

The Everyday Price Index (EPI) rose to 293.8 in April 2025 on the heels of an 0.34 percent gain. This marks the fifth monthly increase in a row for AIER’s proprietary inflation measure.

Among the twenty-four constituents of the EPI, 13 rose in price from March to April, two were unchanged, and nine declined. The three categories seeing the largest price increases were motor fuel (one of the largest decliners last month), admission to movies, theaters, and concerts, and nonprescription drugs. Internet services and electronic information providers, purchase, subscription, and rental of video, and fees for lessons and instructions showed the biggest declines.

AIER Everyday Price Index vs. US Consumer Price Index (NSA, 1987 = 100)

Chart

(Source: Bloomberg Finance, LP)

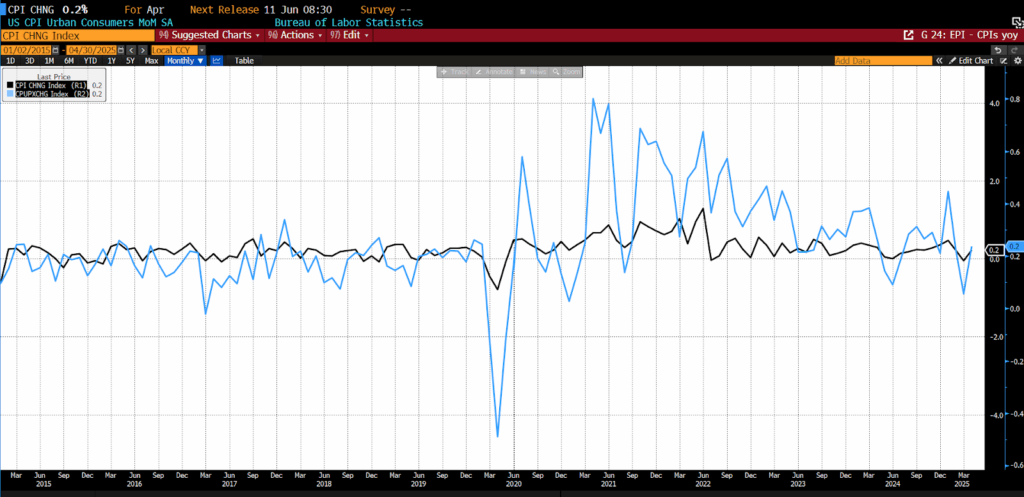

Also on May 13, 2025, the US Bureau of Labor Statistics (BLS) released its April 2025 Consumer Price Index (CPI) data. Both the month-to-month headline CPI and core month-to-month CPI number increased by 0.2 percent, less than the 0.3 percent increase forecast for both.

April 2025 US CPI headline & core month-over-month (2015 – present)

Month-to-month headline inflation in April reflected mixed monthly pressures. The energy index rose 0.7 percent, reversing March’s 2.4 percent decline. This was driven by a 3.7 percent jump in natural gas and a 0.8 percent increase in electricity, while gasoline fell 0.1 percent (though it rose 2.9 percent before seasonal adjustment). The food index declined 0.1 percent, led by a 0.4 percent drop in food at home, the sharpest since September 2020. Major grocery categories declined, including eggs down 12.7 percent, meats, poultry, fish, and eggs down 1.6 percent, fruits and vegetables down 0.4 percent, cereals and bakery products down 0.5 percent, and dairy down 0.2 percent, while nonalcoholic beverages rose 0.7 percent. Food away from home increased 0.4 percent, with full service meals up 0.6 percent and limited service meals up 0.3 percent.

Core inflation, which excludes food and energy, rose 0.2 percent in April, following a 0.1 percent increase in March. Shelter costs rose 0.3 percent, with owners’ equivalent rent up 0.4 percent and rent of primary residence up 0.3 percent, while lodging away from home slipped 0.1 percent. Household furnishings and operations jumped 1.0 percent, and motor vehicle insurance rose 0.6 percent. Education and personal care each edged up 0.1 percent. Offsetting some of these gains, airline fares dropped 2.8 percent, extending a steep decline from March, and used cars and trucks fell 0.5 percent. Indexes for communication and apparel also declined, while new vehicles and recreation were flat. Medical care rose 0.5 percent, including hospital services up 0.6 percent, physicians’ services up 0.3 percent, and prescription drugs up 0.4 percent.

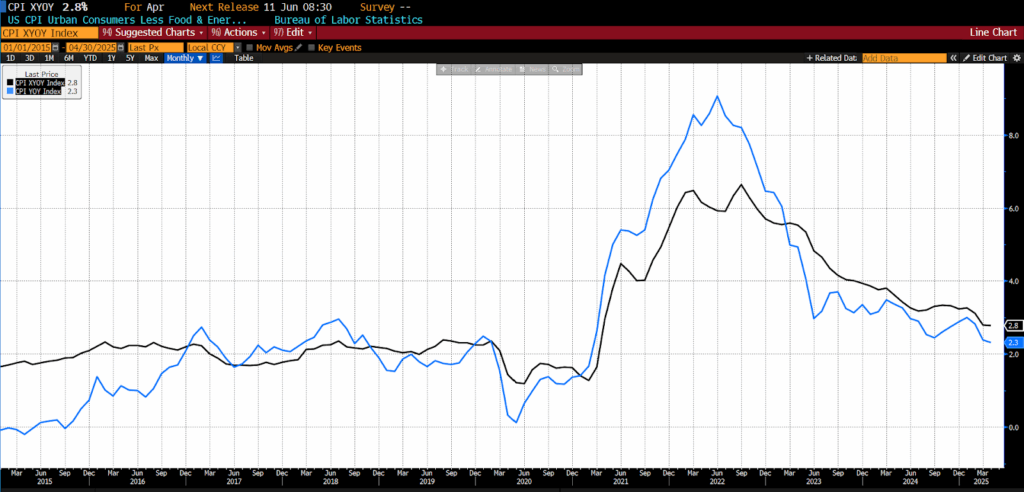

From April 2024 to April 2025 the headline index rose 2.3 percent, lower than surveyed expectations of a 2.4 percent rise.

April 2025 US CPI headline & core year-over-year (2015 – present)

Over the past 12 months, headline inflation reflected diverging trends in food and energy. The food at home index rose 2.0 percent, led by a 7.0 percent increase in meats, poultry, fish, and eggs, with eggs alone up 49.3 percent. Nonalcoholic beverages rose 3.2 percent, dairy products increased 1.6 percent, and other food at home edged up 0.7 percent, while cereals and bakery products were flat and fruits and vegetables declined 0.9 percent. Food away from home climbed 3.9 percent, with full service meals up 4.3 percent and limited service meals up 3.4 percent. Meanwhile, the energy index declined 3.7 percent, driven by sharp drops in gasoline (down 11.8 percent) and fuel oil (down 9.6 percent), partially offset by increases in natural gas (up 15.7 percent) and electricity (up 3.6 percent).

Core inflation (all items less food and energy) rose 2.8 percent over the 12 months ending in April, matching the prior month’s pace and remaining well above the headline rate of 2.3 percent, which marked the smallest annual gain since February 2021. Shelter costs increased 4.0 percent year over year, continuing to exert strong upward pressure. Other notable annual core gains included motor vehicle insurance up 6.4 percent, education up 3.8 percent, medical care up 2.7 percent, and recreation up 1.6 percent. The broader food index rose 2.8 percent, while energy declined 3.7 percent, helping to moderate overall inflation.

The April 2025 CPI data revealed a modest increase in inflation. While it reveals a slight acceleration from March’s subdued figures, overall inflation pressures remain relatively contained. Price gains in tariff-sensitive goods such as furniture, appliances, and electronics, probably reflecting some pass-through from President Trump’s “Liberation Day” tariff hikes, were partially offset by softness in categories like new and used vehicles and apparel. Of particular note, services inflation remained restrained due to ongoing disinflation in leisure-related categories such as lodging and airfares, both of which posted monthly declines. Shelter costs, however, continued to climb steadily and remain a central driver of core inflation.

The evolving effects of tariffs are becoming more visible in the goods sector. After several months of deflation in China-heavy import categories, April showed early signs of a pricing rebound, with some goods shifting from negative to modestly positive monthly inflation. Still, the overall pass-through remains limited as many importers are either absorbing higher input costs or continuing to draw from pre-tariff inventories. Disinflation was slightly more pervasive in April, with nearly 40 percent of core CPI components experiencing monthly price declines. The spread of categories showing annualized inflation above 4 percent ticked up slightly, but those in the 2–4 percent range edged lower, underscoring the uneven nature of current inflation dynamics.

Despite the mild upside in both headline and core inflation, financial markets interpreted the report as broadly benign. Treasury yields dipped briefly but retraced, and rate cut expectations remain priced in for later this year. While April’s data showed more tariff-related inflation pressure than previous months, it was counterbalanced by deflation in key services. Looking ahead and barring any considerable rollback in tariff policies, a lagged increase in core goods prices is likely as older inventories are exhausted; but whether that materializes into broader inflationary momentum remains uncertain. For now, the Fed is data focused and maintaining flexibility in its policy stance.